Artificial Intelligence (AI) is revolutionizing the finance industry by enhancing efficiency, accuracy, and decision-making processes. In this blog post, we will delve into the applications of AI in finance, provide detailed examples, and explore the tools used in these applications.

AI in Fraud Detection and Prevention

Fraud detection and prevention are critical aspects of the finance industry where Artificial Intelligence (AI) has made significant advancements. This blog post delves deeper into how AI is revolutionizing fraud detection and prevention, providing examples, tools, and applications.

Understanding Fraud Detection and Prevention with AI

Fraud detection involves identifying dishonest or illegal activities, while prevention focuses on stopping these activities before they occur. Traditional methods often rely on rule-based systems, which can be slow and ineffective against sophisticated fraud schemes. AI, with its ability to learn and adapt, offers a robust solution by analyzing large volumes of data in real-time, identifying patterns, and predicting potential fraudulent activities.

How AI Enhances Fraud Detection and Prevention

Real-Time Analysis

AI can analyze transactions as they happen, identifying anomalies and potential fraud instantly. This real-time capability is crucial in preventing fraud before it causes significant damage.

Pattern Recognition

Machine learning algorithms can identify patterns that may indicate fraudulent behavior. These patterns could include unusual transaction amounts, atypical transaction locations, or rapid transactions that deviate from the norm.

Predictive Modeling

AI can predict potential fraud by analyzing historical data and identifying trends. Predictive models can be continuously updated with new data, improving their accuracy over time.

Tools Used in AI-Based Fraud Detection and Prevention

1. TensorFlow

TensorFlow is an open-source machine learning framework developed by Google. It is widely used for building and deploying machine learning models, including those for fraud detection.

Example: TensorFlow can be used to develop a neural network model that analyzes transaction data to identify potential fraud. The model can be trained on historical transaction data to learn patterns associated with fraudulent activities.

2. Scikit-Learn

Scikit-Learn is a Python library for machine learning. It provides simple and efficient tools for data analysis and modeling.

Example: Scikit-Learn can be used to implement algorithms such as Random Forests or Support Vector Machines (SVM) to classify transactions as fraudulent or legitimate based on various features.

3. IBM Watson

IBM Watson offers a suite of enterprise-ready AI services. It includes tools for data analysis, natural language processing, and machine learning.

Example: IBM Watson can be used to create a comprehensive fraud detection system that integrates multiple data sources, including transaction data, customer information, and social media activity, to detect fraud in real-time.

Examples of AI in Fraud Detection and Prevention

PayPal

Implementation: PayPal uses machine learning algorithms to analyze transactions for fraud. The system examines various factors, such as transaction amount, frequency, and location, to identify suspicious activities.

Outcome: By leveraging AI, PayPal can quickly and accurately detect fraudulent transactions, significantly reducing fraud losses and improving customer trust.

Mastercard

:max_bytes(150000):strip_icc()/MClogo-c823e495c5cf455c89ddfb0e17fc7978.jpg)

Implementation: Mastercard employs AI to monitor and analyze transaction data. The AI system uses machine learning models to detect unusual spending patterns that may indicate fraud.

Outcome: Mastercard’s AI-driven fraud detection system has enhanced its ability to identify and prevent fraudulent transactions, protecting both the company and its customers.

JP Morgan Chase

Implementation: JP Morgan Chase uses AI to analyze market data and predict potential risks. The AI system helps the bank identify fraudulent activities and manage risk more effectively.

Outcome: The bank’s AI-powered fraud detection and risk management systems have improved its ability to prevent fraud and mitigate financial losses.

Applications of AI in Fraud Detection and Prevention

Credit Card Fraud Detection

AI can analyze credit card transactions in real-time to detect unusual patterns that may indicate fraud. By comparing each transaction against historical data, AI can flag suspicious activities for further investigation.

Tools Used: TensorFlow, Scikit-Learn, IBM Watson

Insurance Fraud Detection

AI can analyze insurance claims to identify potential fraud. Machine learning models can detect patterns such as unusually high claims or frequent claims from the same individual or entity.

Tools Used: RapidMiner, KNIME, H2O.ai

Identity Theft Prevention

AI can monitor user behavior across various platforms to detect signs of identity theft. For example, AI can analyze login patterns, IP addresses, and device information to identify suspicious activities.

Tools Used: Microsoft Azure AI, Amazon SageMaker, Google Cloud AI

AI in Algorithmic Trading

Algorithmic trading, also known as algo-trading, involves using computer algorithms to automate trading strategies. These algorithms can analyze vast amounts of data, identify patterns, and execute trades at speeds and frequencies that are impossible for human traders. In this blog post, we will explore the intricacies of algorithmic trading with AI, providing examples, tools used, and detailed applications.

Understanding Algorithmic Trading with AI

Algorithmic trading leverages AI and machine learning to make trading decisions based on data analysis. These algorithms can process large datasets to identify market trends and execute trades at optimal times, often resulting in increased profitability and reduced risk.

How AI Enhances Algorithmic Trading

Speed and Efficiency

AI can analyze data and execute trades in milliseconds, far faster than any human trader. This speed is crucial in high-frequency trading (HFT), where the ability to execute trades quickly can lead to significant profits.

Data Analysis

AI can analyze vast amounts of historical and real-time data to identify patterns and trends. This analysis helps in making informed trading decisions and developing strategies that adapt to changing market conditions.

Predictive Modeling

AI uses machine learning models to predict future market movements based on historical data. These predictive models can continuously improve as they are exposed to more data, enhancing their accuracy over time.

Tools Used in AI-Based Algorithmic Trading

1. QuantConnect

QuantConnect is an algorithmic trading platform that allows users to design, test, and deploy trading algorithms. It supports multiple asset classes, including equities, forex, and cryptocurrencies.

Example: A trader can use QuantConnect to develop an algorithm that trades based on moving averages. The platform provides backtesting capabilities to test the algorithm against historical data before deploying it in live trading.

2. MetaTrader

MetaTrader is a popular trading platform that supports algorithmic trading through its built-in scripting language, MQL (MetaQuotes Language). It is widely used in forex and CFD trading.

Example: A trader can write an MQL script to implement a trading strategy based on technical indicators such as RSI (Relative Strength Index) and Bollinger Bands. The script can be tested and optimized using MetaTrader’s strategy tester.

3. Alpaca

Alpaca is a commission-free trading platform that provides an API for building and deploying trading algorithms. It supports equities trading on US exchanges.

Example: A developer can use Alpaca’s API to create an algorithm that trades based on earnings reports. The algorithm can automatically buy or sell stocks based on the sentiment analysis of the earnings report.

Examples of AI in Algorithmic Trading

Renaissance Technologies

Implementation: Renaissance Technologies, a hedge fund, uses AI-driven algorithms to analyze market data and make trading decisions. The firm’s Medallion Fund, in particular, is known for its high-frequency trading strategies powered by AI.

Outcome: The Medallion Fund has achieved consistently high returns, significantly outperforming the market over the past few decades.

Two Sigma

Implementation: Two Sigma, another hedge fund, uses AI and machine learning to develop trading algorithms. The firm analyzes a wide range of data sources, including market data, economic indicators, and alternative data, to identify trading opportunities.

Outcome: Two Sigma’s AI-driven approach has led to impressive returns and a reputation as one of the leading quantitative hedge funds.

Goldman Sachs

Implementation: Goldman Sachs employs AI in its trading strategies to analyze market trends and execute trades. The firm uses machine learning models to predict market movements and optimize its trading strategies.

Outcome: AI has enabled Goldman Sachs to enhance its trading efficiency, reduce risk, and improve profitability.

Applications of AI in Algorithmic Trading

High-Frequency Trading (HFT)

High-frequency trading involves executing a large number of trades at very high speeds. AI algorithms analyze market data and execute trades in milliseconds, taking advantage of small price movements.

Tools Used: QuantConnect, MetaTrader, Alpaca

Market Making

Market making involves providing liquidity to the market by simultaneously buying and selling a particular asset. AI algorithms can adjust prices in real-time based on market conditions, ensuring profitability.

Tools Used: MetaTrader, Alpaca, QuantConnect

Statistical Arbitrage

Statistical arbitrage involves exploiting price differences between related assets. AI algorithms analyze historical price data to identify and exploit these differences.

Tools Used: QuantConnect, DataRobot, H2O.ai

Sentiment Analysis

Sentiment analysis involves analyzing news articles, social media posts, and other text data to gauge market sentiment. AI algorithms can trade based on the sentiment scores derived from this analysis.

Tools Used: IBM Watson, Google Cloud Natural Language, Hugging Face Transformers

AI in Risk Management

Risk management is a critical function in the finance industry, and Artificial Intelligence (AI) has brought significant advancements in this area. AI enhances the ability to assess, monitor, and mitigate risks by analyzing large datasets, identifying patterns, and providing predictive insights. In this blog post, we will delve into the intricacies of AI in risk management, providing examples, tools used, and detailed applications.

Understanding Risk Management with AI

Risk management involves identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, monitor, and control the probability or impact of unfortunate events. AI contributes to risk management by providing more accurate risk assessments, real-time monitoring, and predictive analytics.

How AI Enhances Risk Management

Data Analysis

AI can analyze vast amounts of structured and unstructured data to identify potential risks. This includes financial statements, market data, news articles, and social media activity.

Predictive Modeling

AI uses machine learning models to predict future risks based on historical data. These models can identify trends and patterns that may indicate potential risks, allowing organizations to take proactive measures.

Real-Time Monitoring

AI systems can monitor various data sources in real-time to detect emerging risks. This enables organizations to respond quickly and mitigate risks before they escalate.

Tools Used in AI-Based Risk Management

1. SAS

SAS is a software suite for advanced analytics, business intelligence, and data management. It provides powerful tools for risk analysis and management.

Example: SAS can be used to develop risk models that analyze credit risk, market risk, and operational risk. These models can be used to assess the risk levels of various financial instruments and portfolios.

2. RapidMiner

RapidMiner is a data science platform that allows users to build, deploy, and maintain predictive models. It provides tools for data preparation, machine learning, and model validation.

Example: A financial institution can use RapidMiner to create a predictive model that assesses the risk of loan defaults based on customer data. The model can be continuously updated with new data to improve its accuracy.

3. KNIME

KNIME is an open-source platform for data analytics, reporting, and integration. It provides a wide range of tools for data analysis and machine learning.

Example: KNIME can be used to integrate and analyze data from multiple sources, such as financial statements, market data, and social media activity, to identify potential risks.

Examples of AI in Risk Management

JPMorgan Chase

Implementation: JPMorgan Chase uses AI to analyze market data and predict potential risks. The AI system helps the bank identify fraudulent activities, assess credit risk, and manage market risk.

Outcome: The bank’s AI-powered risk management systems have improved its ability to prevent fraud, mitigate financial losses, and make more informed decisions.

HSBC

Implementation: HSBC uses AI to monitor and analyze transactions for money laundering and other financial crimes. The AI system analyzes transaction patterns and flags suspicious activities for further investigation.

Outcome: HSBC’s AI-driven risk management system has enhanced its ability to detect and prevent financial crimes, ensuring compliance with regulatory requirements.

ING

Implementation: ING uses AI to assess credit risk and manage loan portfolios. The AI system analyzes customer data, market conditions, and economic indicators to predict the likelihood of loan defaults.

Outcome: ING’s AI-powered risk management system has improved its ability to assess credit risk, reduce loan defaults, and optimize loan portfolios.

Applications of AI in Risk Management

Credit Risk Assessment

AI can analyze customer data, including credit history, income, and spending patterns, to assess credit risk. Machine learning models can predict the likelihood of loan defaults and help financial institutions make more informed lending decisions.

Tools Used: SAS, RapidMiner, KNIME

Market Risk Management

AI can analyze market data to identify potential market risks, such as price fluctuations and market volatility. Predictive models can provide insights into future market movements, helping organizations mitigate market risk.

Tools Used: H2O.ai, DataRobot, Apache Spark

Fraud Detection and Prevention

AI can analyze transaction data to detect fraudulent activities. Machine learning algorithms can identify patterns and anomalies that may indicate fraud, enabling organizations to take preventive measures.

Tools Used: TensorFlow, Scikit-Learn, IBM Watson

Operational Risk Management

AI can analyze various data sources, including financial statements, employee data, and operational processes, to identify operational risks. Predictive models can help organizations mitigate these risks and improve operational efficiency.

AI in Customer Service and Support

Artificial Intelligence (AI) is revolutionizing customer service and support in the finance industry by providing faster, more accurate, and personalized responses to customer inquiries. This blog post delves into the applications of AI in customer service, providing examples, tools used, and detailed applications.

Understanding AI in Customer Service and Support

AI in customer service involves using technologies such as chatbots, virtual assistants, and natural language processing to automate and enhance customer interactions. These AI-driven tools can handle a wide range of tasks, from answering common questions to assisting with complex transactions, thereby improving customer satisfaction and operational efficiency.

How AI Enhances Customer Service and Support

24/7 Availability

AI-powered chatbots and virtual assistants can provide round-the-clock support, ensuring that customers receive assistance whenever they need it.

Personalized Responses

AI can analyze customer data to provide personalized responses and recommendations, improving the customer experience.

Efficiency and Scalability

AI can handle a large volume of customer inquiries simultaneously, making customer service operations more efficient and scalable.

Tools Used in AI-Based Customer Service and Support

1. Microsoft Bot Framework

The Microsoft Bot Framework is a comprehensive platform for building, connecting, and managing intelligent bots. It supports various channels, including web, mobile, and social media.

Example: A bank can use the Microsoft Bot Framework to develop a chatbot that assists customers with account inquiries, balance checks, and transaction histories.

2. Dialogflow

Dialogflow, developed by Google, is a natural language understanding platform for building conversational interfaces. It supports voice and text-based interactions.

Example: A financial institution can use Dialogflow to create a virtual assistant that helps customers with loan applications, providing information about loan products, interest rates, and eligibility criteria.

3. Rasa

Rasa is an open-source framework for building AI chatbots and assistants. It offers customizable tools for natural language understanding and dialogue management.

Example: An insurance company can use Rasa to develop a chatbot that assists customers with policy inquiries, claims processing, and premium calculations.

Examples of AI in Customer Service and Support

Bank of America – Erica

Implementation: Bank of America’s virtual assistant, Erica, uses AI to help customers with a wide range of tasks, including checking account balances, transferring money, and paying bills. Erica also provides personalized financial advice based on customers’ spending patterns and financial goals.

Outcome: Erica has improved customer satisfaction by providing quick and accurate responses, reducing the need for customers to visit a branch or call customer service.

HSBC – AI Chatbot

Implementation: HSBC uses an AI-powered chatbot to assist customers with common inquiries, such as account information, transaction history, and branch locations. The chatbot also provides information about HSBC’s products and services.

Outcome: The AI chatbot has reduced the workload of human agents, allowing them to focus on more complex inquiries. It has also improved response times and customer satisfaction.

Capital One – Eno

Implementation: Capital One’s virtual assistant, Eno, uses AI to provide real-time assistance to customers. Eno can answer questions about account balances, recent transactions, and payment due dates. It also monitors accounts for unusual activity and alerts customers to potential fraud.

Outcome: Eno has enhanced Capital One’s customer service by providing instant support and proactive fraud alerts, improving overall customer experience and trust.

Applications of AI in Customer Service and Support

Automated Inquiry Handling

AI chatbots can handle common customer inquiries, such as account balances, transaction history, and branch locations, freeing up human agents to focus on more complex issues.

Tools Used: Microsoft Bot Framework, Dialogflow, Rasa

Loan and Mortgage Assistance

AI virtual assistants can assist customers with loan and mortgage applications, providing information about loan products, interest rates, and eligibility criteria.

Tools Used: Dialogflow, IBM Watson, Amazon Lex

Fraud Detection and Alerts

AI can monitor customer accounts for unusual activity and send real-time alerts to customers, helping to prevent fraud and enhance security.

Tools Used: TensorFlow, Scikit-Learn, Microsoft Azure AI

Personalized Financial Advice

AI can analyze customers’ financial data to provide personalized advice and recommendations, helping them manage their finances better.

Tools Used: IBM Watson, Google Cloud AI, DataRobot

Claims Processing in Insurance

AI chatbots can assist customers with insurance claims processing, guiding them through the necessary steps and documentation.

Tools Used: Rasa, Dialogflow, Microsoft Bot Framework

AI in Personal Finance Management

AI is revolutionizing personal finance management by providing individuals with sophisticated tools to manage their finances more effectively. From budgeting and expense tracking to investment advice and savings optimization, AI-driven applications offer personalized, data-driven insights that can help users make better financial decisions. In this blog post, we will explore how AI is enhancing personal finance management, with detailed examples, tools used, and applications.

Understanding AI in Personal Finance Management

Personal finance management involves managing one’s financial activities, such as budgeting, saving, investing, and planning for retirement. AI can assist in these tasks by analyzing financial data, identifying patterns, and providing personalized recommendations.

How AI Enhances Personal Finance Management

Personalized Budgeting and Expense Tracking

AI can analyze spending habits and categorize expenses automatically, providing a clear picture of where money is going. It can also offer personalized budgeting advice based on individual spending patterns.

Investment Advice

AI-powered robo-advisors can provide personalized investment advice based on an individual’s risk tolerance, financial goals, and market conditions. These advisors use complex algorithms to optimize investment portfolios.

Savings Optimization

AI can analyze an individual’s financial behavior and suggest ways to save money, such as identifying unnecessary subscriptions or finding better deals on recurring expenses.

Financial Planning

AI can assist with long-term financial planning by analyzing an individual’s financial situation and providing tailored advice for retirement planning, debt management, and other financial goals.

Tools Used in AI-Based Personal Finance Management

1. Mint

Mint is a popular personal finance app that uses AI to track expenses, create budgets, and provide financial insights. It automatically categorizes transactions and offers personalized tips for saving money.

Example: Mint can analyze a user’s spending habits and suggest a budget for different categories, such as groceries, entertainment, and transportation. It also alerts users when they are overspending in a particular category.

2. YNAB (You Need A Budget)

YNAB is a budgeting app that helps users manage their finances by allocating income to specific expense categories. It uses AI to provide insights and suggestions for optimizing budgets.

Example: YNAB can identify patterns in a user’s spending and suggest adjustments to the budget to help save more money. It also provides real-time updates on budget status and goals.

3. Wealthfront

Wealthfront is a robo-advisor that uses AI to provide personalized investment advice and portfolio management. It offers a range of financial planning tools, including retirement planning and college savings.

Example: Wealthfront can create a customized investment portfolio based on a user’s risk tolerance and financial goals. It continuously monitors and rebalances the portfolio to optimize returns.

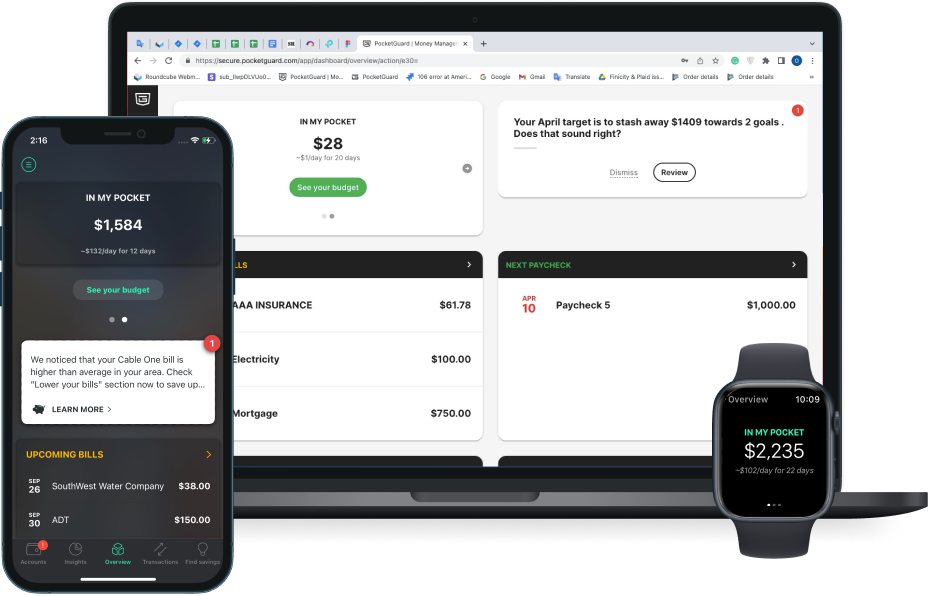

4. PocketGuard

PocketGuard is a personal finance app that helps users track their spending, set budgets, and find ways to save money. It uses AI to analyze financial data and provide actionable insights.

Example: PocketGuard can analyze a user’s recurring expenses and suggest ways to save money, such as negotiating lower bills or canceling unused subscriptions. It also provides a clear picture of how much money is available for discretionary spending.

5. Acorns

Acorns is a micro-investing app that uses AI to help users invest spare change from everyday purchases. It offers automated investment portfolios and financial education tools.

Example: Acorns can round up a user’s purchases to the nearest dollar and invest the spare change into a diversified portfolio. It also provides personalized financial advice and educational content to help users build their investment knowledge.

Examples of AI in Personal Finance Management

Digit

Implementation: Digit uses AI to analyze users’ income and spending habits to determine safe amounts to save. It automatically transfers small amounts of money into a savings account, helping users save without thinking about it.

Outcome: Digit has helped users save millions of dollars by making the process effortless and automatic. Users report feeling more financially secure and achieving their savings goals faster.

Cleo

Implementation: Cleo is an AI-powered chatbot that helps users manage their finances through a conversational interface. It provides insights into spending habits, suggests budgeting tips, and answers financial questions.

Outcome: Cleo has improved financial literacy and management for its users by providing real-time insights and advice in a friendly and accessible manner. Users appreciate the interactive and engaging approach to managing their finances.

Betterment

Implementation: Betterment is a robo-advisor that uses AI to provide personalized investment advice and portfolio management. It considers factors such as risk tolerance, financial goals, and time horizon to create optimal investment strategies.

Outcome: Betterment has made investing more accessible and efficient for individuals, helping them achieve better financial outcomes through personalized and automated investment management.

Applications of AI in Personal Finance Management

Automated Budgeting

AI can automatically categorize transactions and create budgets based on spending patterns. It can provide real-time updates and alerts to help users stay on track.

Tools Used: Mint, YNAB, PocketGuard

Personalized Investment Advice

AI-powered robo-advisors can create and manage personalized investment portfolios based on an individual’s financial goals and risk tolerance.

Tools Used: Wealthfront, Betterment, Acorns

Savings Optimization

AI can identify ways to save money by analyzing spending habits and suggesting changes, such as canceling unused subscriptions or finding better deals on recurring expenses.

Tools Used: Digit, PocketGuard

Financial Planning and Goal Setting

AI can assist with long-term financial planning by analyzing an individual’s financial situation and providing tailored advice for achieving financial goals, such as retirement planning or debt reduction.

Tools Used: Wealthfront, Betterment, YNAB

Expense Tracking and Analysis

AI can track expenses in real-time, providing insights into spending habits and identifying areas where users can cut costs or reallocate funds.

Tools Used: Mint, PocketGuard, Cleo

AI in Credit Scoring

Traditional credit scoring models rely heavily on historical data and may not always provide an accurate picture of an individual’s creditworthiness. AI, however, can analyze a broader range of data points, including social media activity, online behavior, and more, to provide a more comprehensive credit score.

Example: ZestFinance uses machine learning models to analyze alternative data sources and provide credit scores for individuals with limited credit history. This approach has helped increase financial inclusion and reduce default rates.